Sperax Basics

Sperax is open source financial software built around the SperaxUSD (USDs) stablecoin. USDs is the largest decentralized stablecoin on Arbitrum. With its governance token (SPA) alongside, USDs provides a target auto-yield to its holders of 8-10%. This auto-yield is produced organically by the collateral of USDs working in DeFi protocols such as Curve. This auto-yield is distributed in a gasless manner via a rebase to the holders of USDs. To be eligible for auto-yield the user must simply hold USDs liquid in their wallet, no further staking/claiming/etc is necessary.

USDs

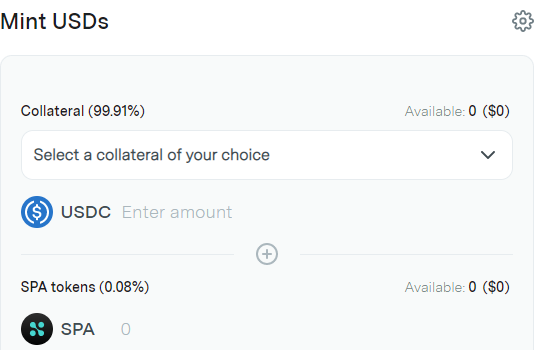

The largest decentralized stablecoin on Arbitrum, USDs is fully collateralized. USDs can be minted directly from the Sperax protocol using collateral such as USDC and USDT.

More collateral types will be added in the near future! Being fully collateralized makes USDs very safe and secure. The $1 peg of USDs is maintained by arbitrageurs on the open market. Arbitrageurs are always incentivized to keep USDs’ $1 peg due to always being able to exchange 1:1 no matter the market conditions. USDs has concentrated liquidity within the Arbitrum network with farms on Uniswap and Saddle. Further, in the near future, Sperax will be releasing a Farm Factory contract to provide liquidity as a service against USDs. This will both drive the TVL of USDs and deepen the liquidity.

SPA

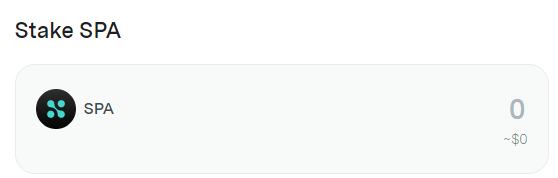

SPA is the governance token of the Sperax protocol. Users can acquire SPA on various centralized exchanges such as FTX, Huobi, gate.io and Kucoin. Kucoin offers direct withdrawals to Arbitrum, the first token with this support ever on Kucoin. SPA can also be acquired via a DEX on Uniswap. SPA tokens can be staked into the veSPA protocol.

SPA can be staked for any interval up to 4 years. Users who stake their SPA will receive veSPA in return. This veSPA will determine their voting rights in the upcoming DAO as well as determine the weekly rewards they will receive for staking. Staking rewards are accrued via three mechanisms and distributed to SPA stakers. First, 50% of the yield generated by USDs collateral is used to buy back SPA on the open market. Second, 100% of fees generated during minting/redeeming of USDs. Lastly, a Treasury incentive is also applied. These 3 main sources of capital are generated on a weekly basis and used to buyback SPA on the open market. These SPA tokens are then distributed to SPA stakers. This provides buying pressure on SPA on a weekly basis. If the price of the SPA token were to decrease, each dollar generated by those 3 sources will buy back more SPA tokens on the open market. This effect is what we call the “Economic Boomerang”.

SPA token holders who stake will also have the ability to decide different parameters of the Sperax protocol with the release of the DAO. Protocol levers that can be toggled by SPA stakers include collateral type, collateral composition, collateral strategy, algorithmic nature of USDs, auto-yield target, and much more.